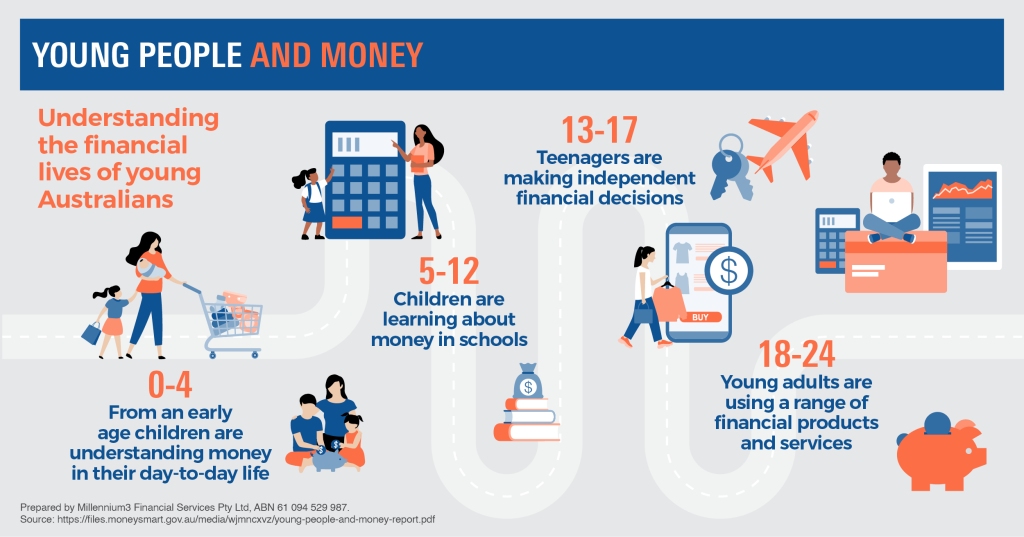

Teaching children healthy money habits

Set a good example for your children with just a few simple changes. As a parent, you try to ensure your children have the skills to make smart financial decisions. For example, you tell them about the importance of saving or the power of compounding interest. But did you know that you could be sending